Work from home? Live on a farm? Got a college degree? All of these can score you a discount on your next car insurance policy.

While you probably see or hear advertisements from auto insurance companies every day, you rarely hear the details about how you can get extra discounts. Companies love to draw you in with promises of savings. What they do not tell you is that even more savings may be available to you. All you need to do is ask.

- Low mileage drivers: If you only have a short commute to work or work from home frequently, you may not put many miles on your vehicle throughout the year. While the mileage numbers and discounts vary by company, drivers with low annual mileage can save about 10% on their insurance. Discounts may also be available if you only drive a couple of days each week.

- Stick with them and renew early: The longer you stay with one insurance provider, the greater your discount. If you have been with your provider for more than three years, it’s worth asking about. Many companies also reward drivers when their policies are renewed a couple of weeks before the expiration date.

- Bundle it: Most individuals know that having a homeowner’s or rental policy with the same company will provide them with a discount. However, having a life insurance policy with the same company can also give you a discount. In addition, if you own your residence, you can save another 5% or so with some insurance companies.

- Good student or college graduate: If you have younger drivers on your policy, ask about a discount for higher grade point averages. Some companies also provide discounts to drivers with a four-year degree or higher.

- Farm vehicles: If your vehicle is used primarily for transportation on a farm, you can save an average of 10% extra on your premiums.

- Club memberships: Organizations like AAA offer insurance. If you are an AAA member, you will save even more on your all of your insurance needs.

- Pay it in full: If you can pay your annual policy in full each year rather than opting for monthly payments, you will save money. When you make payments monthly, interest or finance charges are added to your bill. If you cannot pay in full, arrange for an automatic payment from your bank. This could give you a small discount on the monthly payment.

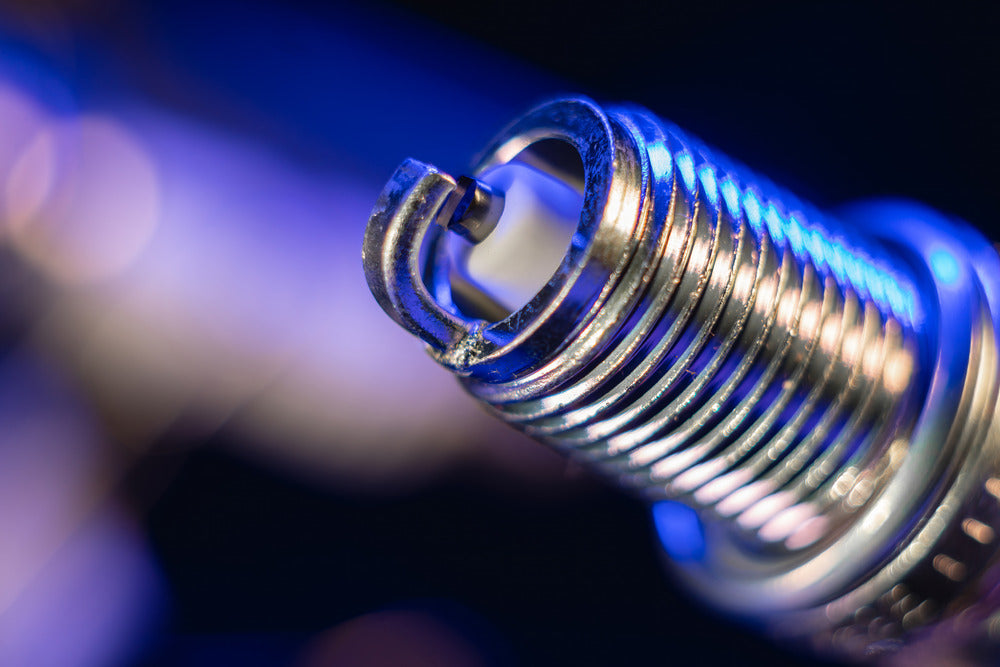

Happy insurance shopping, E3 Spark Plugs fans!